COVID 19 saw the coming of a monetary downturn, and businesses often had to let people go. They were tough two years, and the people often worried about their jobs in every nation.

In the US alone, a lot of people lost their jobs as businesses closed down or shrank in size. It was in March 2020, after a month or two of the COVID attack, that people began panicking and the CARES Act came up.

The program was meant to bring relief to the businesses that got impacted, ensuring they did not have to let go of their employees. The CARES Act gave way to the Employee Retention Credit Act (ARC), under which non-refundable credits were given out as grants.

What is ERC Grant or Loan?

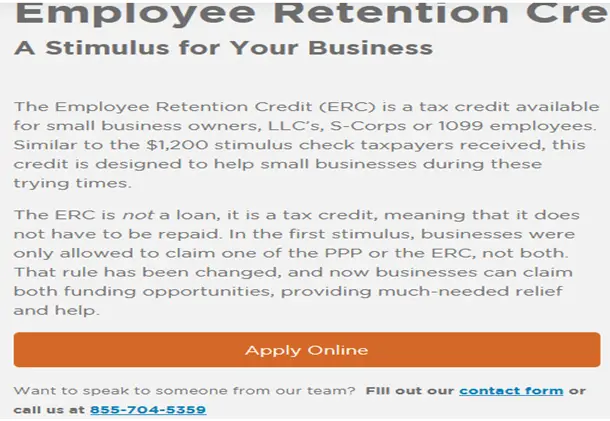

The ERC Grant was made into an act that became law on March 11, 2021. The money given under the scheme is free money from the federal government and is in addition to the PPP money that the employer would have gotten. If you qualify for it, you don’t have to pay it back.

Employers can get almost $5,000 for every employee they have. The ERC loans or wages must have been paid between March 13, 2020, and December 31, 2021.

It is different from the income tax credit and works slightly differently. In 2020, the qualified wage amount was 50%, and in 2021, the credit limit was extended to 70%. This way, the annual limit for an employee was raised to $28,000 for an employer.

It works as a tax credit and is good for small businesses. Basically, it works similar to the stimulus programme, and in the first quarter, a person could either claim the PPP or the ERC. Now businesses can raise a claim for both to provide the much-needed support.

Is ERC Loan & ERC Grant Different?

The ERC loan or grant is different as much as a loan is from a grant. They offer $10 million to small businesses. If you qualify for the loan, you can get 2.5 times the employee’s salary. This loan is subject to forgiveness based on your rent, utilities, payroll costs, and other experiences per W2 employee.

The ERC Grant is again a non-refundable amount that need not be refunded. You don’t even need to ask for forgiveness as is with ERC credit amounts.

Also Read: How to Apply for FEMA Disaster Relief Assistance?

How to Apply for ERC Grant Application?

You can apply through this link here for ERC Grant.

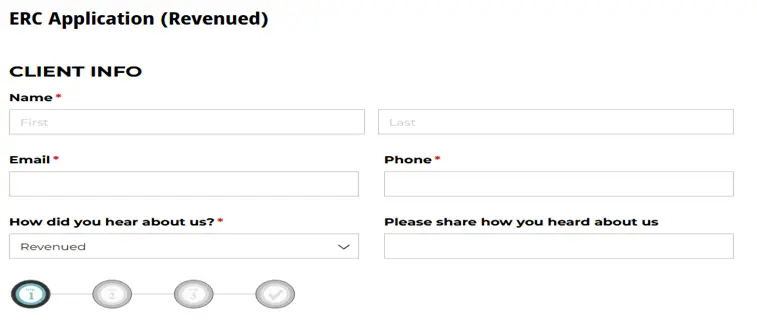

Click on this orange-colored apply online link.

Fill in the client information in the first segment and start by adding the client’s name, email, phone number, and all other small questions.

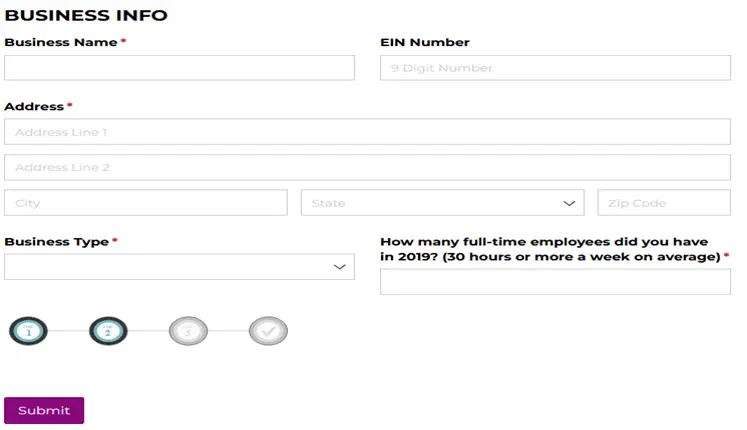

- Add your business information in the next segment, where you need to put your business name, EIN number, address, business type, and also the number of employees you have.

Submit this information, click on their terms and conditions and then finally submit all details.

The ERC application sunset deadline is March 2024.

Who is Eligible?

You are eligible for the program if you fulfil these two requirements.

- If your operation was suspended during a calendar year due to the government’s imposed limitation on trade, travel for other business types for COVID-19.

- Your business’s gross income reduces by more than half when compared to the previous year’s same quarter.

Considering the maximum wage of$10,000, one can take up to $5,000 for every employee.

What are the Application Requirements?

The application requirements for the program would include the following;

- You need to have a US nationality.

- As an individual, to file your ERC application, you must be at least 18 years old for your ERC application.

- A 50% or more decline in revenue in 2020 and a 20% decline in 2021.

- If the revenue decreases in both quarters, you can get benefits for both quarters.

Benefits

These are the following benefits you will get from this particular ERC program.

- It is not a loan and thus you need not pay it back.

- Funding is not limited and anyone qualifying will receive the credit.

- Anyone who claimed the PPP can also claim the ERC.

- You can apply very easily and the application process is very fast.

FAQs (Frequently Asked Questions)

Is ERC grant legit?

The ERC credit is absolutely legitimate, and yet it is a difficult and complicated process and set of rules that kind of create a disturbance in the approval process.

Do grants count as income for ERC?

ERC is not considered a tax, and for ERC, the money sources are fixed, but for the people; grants come as income that need not be repaid.

Does ERC have to be paid back?

No, the grants need not be paid back, and ERC will never ask for the grant amount. Payment for the grants is not possible; however, credit from ERC would mean a payback.

Where does ERC money come from?

The ERC grant comes directly from the Federal government and is an additional amount that the employer will receive alongwith the PPP money.

How much is an ERC starting grant?

Each employer will get half of the amount being paid to their employee as the grant payment.

Conclusion

Here are the entire ERC program details that you can check for yourself if you still think applying for it would make your life better. Those who wish to apply need to know that the timeline is almost coming to an end. People must hurry if they wish to get the benefits. However, the approval complexities might take more time, than one can imagine.

![Low-Income Housing for Disabled Adults, Seniors Near me [2024] housing for disabled adults](https://nammatech.com/wp-content/uploads/2023/03/Low-income-housing-for-disabled-with-no-waiting-list-near-me-USA1-150x150.webp)

![Low-Income Housing for Seniors near me in USA [2024] Low-income-housing-for-seniors](https://nammatech.com/wp-content/uploads/2023/03/Low-income-housing-for-seniors-150x150.webp)

![Low-income housing with no waiting list near me in [2024] Low-income housing with no waiting list near me](https://nammatech.com/wp-content/uploads/2023/03/Low-income-housing-with-no-waiting-list-near-me-150x150.webp)