America’s shift towards electric vehicles (EVs) is gaining momentum, spurred by a range of incentives at federal, state, and local levels. The federal government provides tax credits to encourage people to buy electric cars and plug-in hybrid cars.

However, the passage of the Inflation Reduction Act in 2022 has reshaped the landscape of EV tax credits, ushering in a new era of regulations and opportunities for consumers.

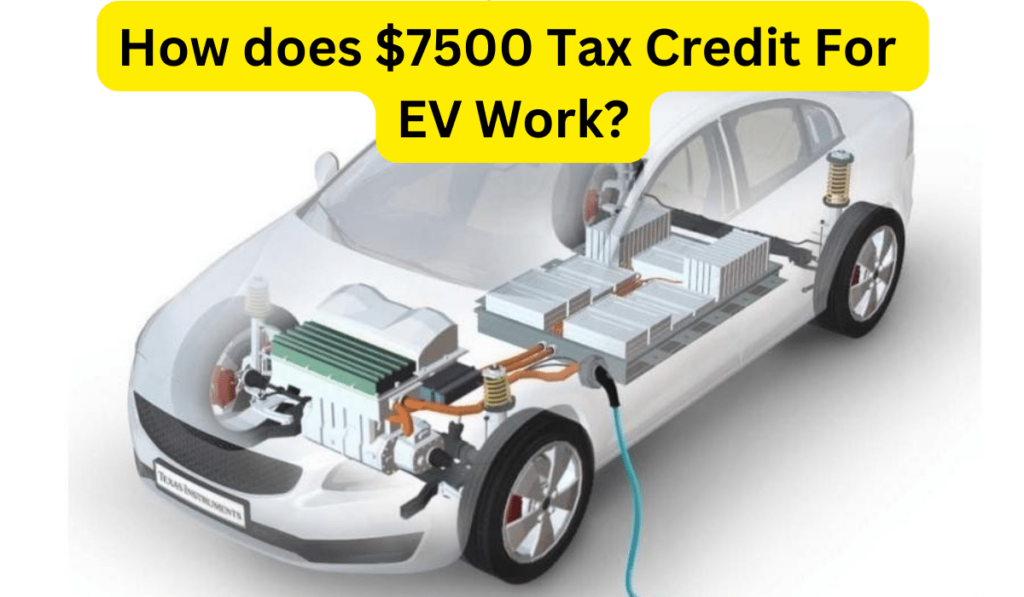

7500 EV Tax Credit

The primary objective of the EV tax credit program is twofold: to encourage consumers to embrace electric vehicles and to bolster the development of a robust North American supply chain for EVs and their components.

Also Read:- Cars that qualify for ev tax credit

Electric vehicle Tax Credit in 2024

Gone are the days of a straightforward $7,500 credit for purchasing a qualifying EV. The revamped system introduced by the Inflation Reduction Act is marked by complexity stemming from income caps, price restrictions, manufacturing requirements, and regulations on component sourcing.

Who Qualifies:

Under the new program, eligibility hinges on factors such as income level, vehicle price, and manufacturing location. Single filers with a modified adjusted gross income (MAGI) exceeding $150,000, joint filers exceeding $300,000, and heads of household surpassing $225,000 are ineligible for the credit.

Also Read:- EV Tax Credit Income Limit For New & Used Electric Vehicles

Vehicle Eligibility:

Not all EV models qualify for the tax credit. Vehicles must meet stringent criteria, including final assembly in North America, adherence to pricing caps, and compliance with sourcing regulations for battery components and raw materials.

Battery Production Requirements:

A significant aspect of the new program revolves around the sourcing of battery components and raw materials. Over the years, the percentage of components and materials required to originate from the U.S. or countries with free trade agreements with the U.S. steadily increases, culminating in full domestic sourcing by 2029.

Implications for EV Market:

While the new regulations pose challenges for automakers in the short term, they are poised to stimulate domestic EV production and supply chain development in the long run. Foreign automakers are compelled to invest in North American production facilities to qualify for the tax credit.

The revised program extends eligibility to leading players like Tesla and General Motors, previously excluded due to volume limits. This adjustment is expected to diversify EV offerings and stimulate competition in the market.

Federal Tax Credit for Used EVs:

Now, you can get a federal tax credit from the government when you buy a used electric car, but there are some rules you have to follow.

Looking Ahead: As the EV landscape continues to evolve, consumers are advised to stay abreast of updates to the list of qualifying vehicles and changes in tax credit regulations. It’s a good idea to talk to a tax expert to make sure you’re following the tax rules that fit your money situation.

FAQs on Federal EV Tax Credit:

How does the federal electric vehicle (EV) tax credit work?

The federal EV tax credit provides a financial incentive to individuals purchasing qualifying electric vehicles. The credit amount, up to $7,500 for new vehicles, is determined by factors such as the vehicle’s sourcing, assembly location, and the year it was placed into service.

Who is eligible for the federal EV tax credit?

Eligibility for the tax credit is contingent on various factors, including the purchaser’s income level, the price of the vehicle, and compliance with manufacturing and sourcing requirements.

Are there income limits for claiming the EV tax credit?

Yes, there are income limits for buying both brand-new and secondhand electric cars.

What are the restrictions on vehicle eligibility?

Vehicles must meet stringent criteria to qualify for the tax credit, including final assembly in North America, adherence to pricing caps, and compliance with sourcing regulations for battery components and raw materials.

When will the federal EV tax credit expire?

The federal EV tax credit is currently set to expire in December 2032, providing a 10-year window for eligible electric vehicles placed into service.

Conclusion:

In conclusion, while the $7,500 tax credit for EVs represents a significant incentive for consumers, navigating the intricate web of eligibility criteria and regulations demands careful consideration. Nevertheless, the overarching goal of promoting sustainable transportation and fostering domestic EV production underscores the importance of these initiatives in shaping the future of mobility in America.

I am the mind behind nammatech.com. I have an experience of more than 8 years in the digital marketing field. The idea behind starting this blog came when one of my friends find it difficult to fill out the application form. So, I came up with an idea to start a blog on this niche.

![Low-Income Housing for Seniors near me in USA [2024] Low-income-housing-for-seniors](https://nammatech.com/wp-content/uploads/2023/03/Low-income-housing-for-seniors-150x150.webp)

![Low-Income Housing for Disabled Adults, Seniors Near me [2024] housing for disabled adults](https://nammatech.com/wp-content/uploads/2023/03/Low-income-housing-for-disabled-with-no-waiting-list-near-me-USA1-150x150.webp)

![Low-income housing with no waiting list near me in [2024] Low-income housing with no waiting list near me](https://nammatech.com/wp-content/uploads/2023/03/Low-income-housing-with-no-waiting-list-near-me-150x150.webp)